Roth ira calculator 2021

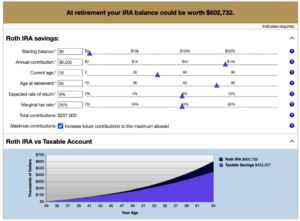

As this Roth IRA calculator shows a 35-year-old with an 80000 annual income who contributes 5500 to a Roth IRA until retiring at 67 could end up with 518000 in savings assuming a 6 annual. Contributions are made using after-tax money.

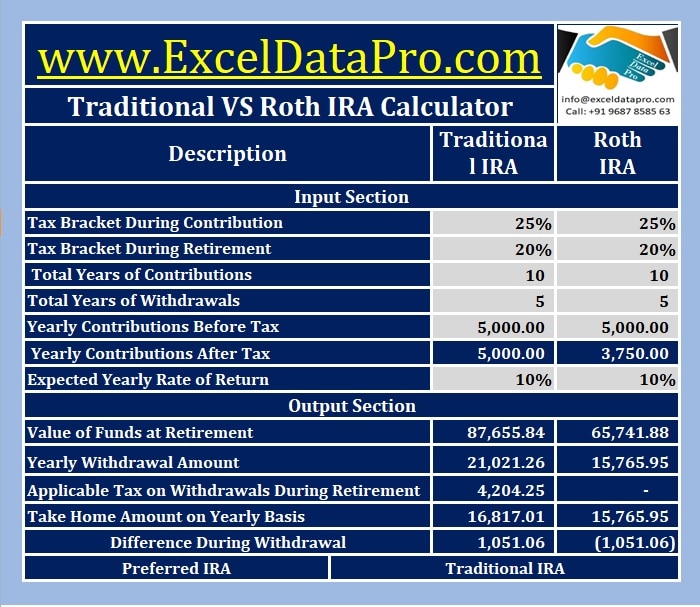

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

For 2021 youre allowed to contribute up to 6000 7000 if youre age 50 or older.

. When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return. Traditional and Roth IRA limits are just 6000. If youre under age 50 you can contribute up to 6000.

Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money. The main benefits are Tax-Free withdrawals during retirement this includes any investment gains in your Roth IRA account. We assume you will live to 95.

You can contribute 6000 for the tax year 2021 and 6000 for the tax year 2022 7000 for tax year 2021 and 7000 for year 2022 if you are at least age 50 or up to 100 of earned income whichever is less. Transfer the assets from the traditional IRA to a Roth IRA. Limits could be lower based on your income.

The key difference between a Roth IRA and a traditional IRA has to do with how and when you are taxed. A Roth IRAs beneficiaries generally will need to take RMDs to avoid penalties although there is an exception for spouses. Contributions are made using after-tax money.

For the unincorporated sole proprietorship you would enter your net income after deductions. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. This little-known strategy only.

Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income MAGI. These tools include the Fidelity Spire app and Retirement Score Calculator. This is a full Fidelity Roth IRA review outlining the pros and cons compared with other Roth IRA Companies other things you need to know about retirement.

So for your 2021 income taxes you can contribute to your Roth IRA up until April 15 2022. A Roth IRA is one of the best accounts for growing tax-free retirement savings and it takes just 15 minutes to open one. Savings.

You can make this transfer and conversion at any point in the future. How is a Roth IRA Different from a Traditional IRA. Regarding the calculator usage you write.

Roth IRA contributions are still a long-term investment in a retirement savings plan. For those who are married and. The Price of Procrastination Calculator.

Contributions are made from income thats already been taxed. Contributions are made using pre-tax money. We automatically distribute your savings optimally among different retirement accounts.

You must designate the account as a Roth IRA when you start the account. Details of Roth IRA Contributions The Roth IRA has contribution limits which are 6000 for 2022. A Roth IRA is a retirement account that lets your investments grow tax-free.

You can use our investment calculator to customize those details for your own financial. However contributions to a Roth IRA arent tax deductible. Use our Roth IRA conversion calculator Were here to help Call 866-855-5635 Chat Professional Answers.

Traditional IRA contributions. Roth IRA Income Limits in 2021. In this article we breakdown the Solo 401K Contribution limits for 2021.

If youre age 50 or older you can contribute up to 7000. A mega backdoor Roth is a special type of 401k rollover strategy used by people with high incomes to deposit funds in a Roth individual retirement account IRA. 6000 or 7000 if youre 50 or older.

Total annual contribution limits are the same for traditional IRAs and Roth IRAs in 2021 and 2022. 158 Click Play to Learn About Required Minimum Distribution RMD. For 2021 the amount you can contribute begins to phase down when your.

ROTH IRA For the 2021 tax year. Estimate your tax refund and where you stand Get started. This means you do not get a tax deduction for contributing to a Roth IRA but the benefits greatly outweigh this.

And what you expect your annual return to be. Open a Schwab Roth IRA. TRADITIONAL IRA For the 2021 tax year.

When investing in Fidelity Roth IRA mutual funds are obviously the best. However there are some exceptions. 3 In 2021.

The catch up contribution is 1000 more if you are 50 years old or older. Open a non-deductible traditional IRA and make after-tax contributions. Contributions are made using pre-tax money.

As of 2021 the maximum a person can contribute to a Roth IRA Account is 6000 per year. A Roth IRA can work as a backup account if you. If your earnings put Roth IRA contributions out of reach a backdoor Roth IRA conversion is a great option that lets you enjoy the tax benefits of a Roth IRA.

2021 contribution limits capped at 6000 if under age 50. A Roth IRA offers many benefits to retirement savers. We stop the analysis there regardless of your spouses age.

If you are eligible you can make tax deductible contributions to a traditional IRA and accumulate earnings within the IRA tax-free until you are required to begin making withdrawalsusually in the year you turn 72. State Tax 529 Calculator. To the maximum amount if your gross income is less than 129000 for single filers and 204000 for married couples.

If you receive an audit letter based on your 2021. The threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household. Make sure you file IRS Form 8606 every year you do this.

7000 if 50 or older. The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. If you are a single or joint filer your maximum contribution starts to reduce at 125000 and 198000 for tax year 2021 and 129000 and 204000 for tax year 2022 respectively.

Family College Savings Road Map. Roth IRAs are subject to the same rules as traditional IRAs. Your 2021 income.

Get details on IRA contribution limits deadlines. We assume that the contribution limits for your retirement accounts increase with inflation. Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement.

When you start taking withdrawals you then need to report the appropriate amounts as income on your tax return and.

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

What Is The Best Roth Ira Calculator District Capital Management

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Excel Template For Free

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

The Ultimate Interactive Roth Ira Calculator Blog

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator How Much Could My Roth Ira Be Worth

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha